Welcome to

Qantas Travel Money

The only prepaid card to reward you with

Qantas Points

Powered by

Earn 1.5 Qantas Points for every AU$1 spent in foreign currency.1

Made for travel

Made for travel

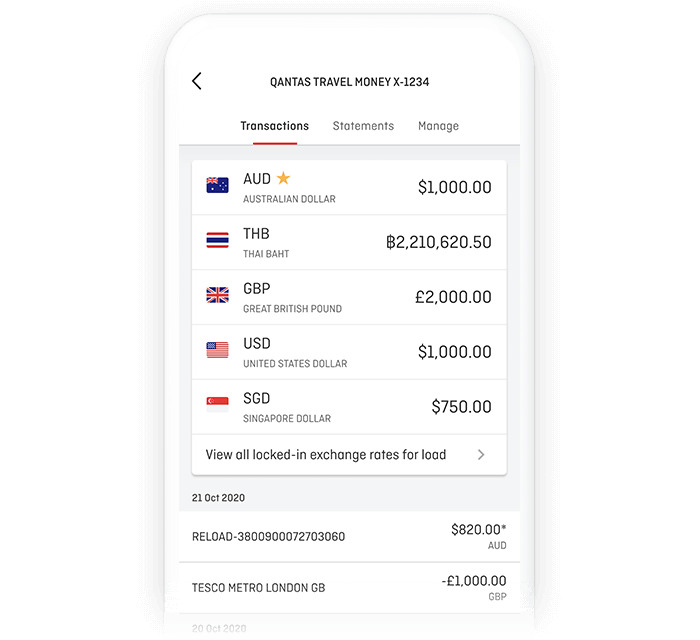

Manage your money on the go

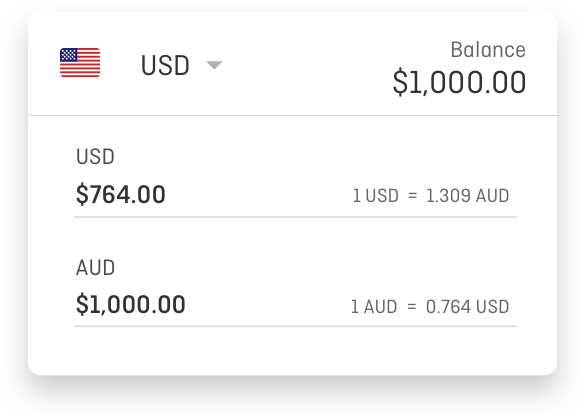

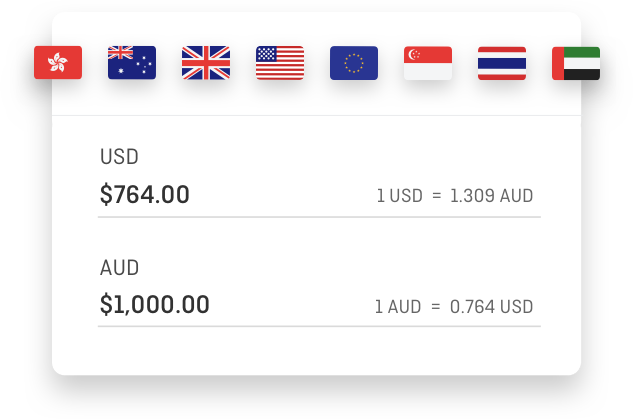

Lock in exchange rates on up to 10 currencies or load AUD to use worldwide.3

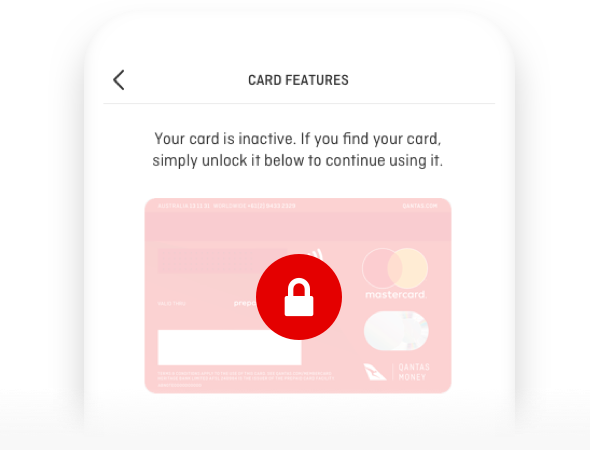

Keep your money safe worldwide

Temporarily lock your card and access emergency funds if it’s lost or stolen. Plus access 24/7 Mastercard® Global Support.8

Save on fees

No monthly fees and fee-free load options at competitive rates.3

Earn Qantas Points

Earn 1.5 Qantas Points for every AU$1 spent in foreign currency.1

Awarded by

Best Travel Money Solution RFi Group Australian Banking Innovation Awards

Manage your

money on the go

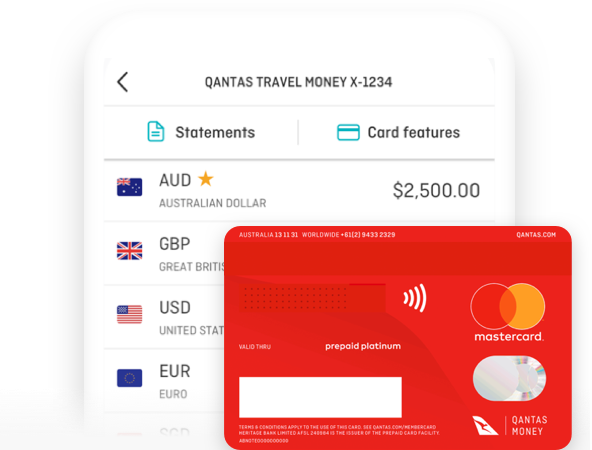

- Load up to 10 foreign currencies4

USD, GBP, EUR, THB, NZD, SGD, HKD, CAD, JPY, AED - Lock in exchange rates before you go3

- Transfer between currencies

- Load Australian dollars and spend worldwide2

Keep your money safe worldwide

- Lock your card if it’s lost or stolen

- 24/7 Mastercard Global Support

- Access to emergency funds

- Fraud protection with Mastercard Zero Liability8

Save on fees

$0

Monthly account fees

$0

Currency conversion fees5

$0

Load fees

$0

Card to card transfer fees

$0

ATM fees within Australia6

0.5%

Debit card instant load fee

Lock in competitive rates3

Earn Qantas Points

Qantas Travel Money is the only prepaid card that rewards you with Qantas Points for spending worldwide.1

1.5 PTS

1.5 Qantas Points for every AU$1 spent in foreign currency1

1 PT

1 Qantas Point for every AU$4 spent in Australian dollars1

See how it works. It’s easy.

- Get your card

- Activate

- Load

- Use

- Manage

Get your Qantas Travel Money card

Not yet a Qantas Frequent Flyer member? Join now for free and save $99.50

Join.

Already a Qantas Frequent Flyer but don't have a Qantas Travel Money card? Request a card

Request a card

Received your Qantas Travel Money Card. What now?

- Make sure you have your Qantas Travel Money card, address details, drivers licence and passport handy

- Log in to activate your card

Load Travel Money

- Log in to the Qantas Money app or website

- Choose your currency (or currencies)

- Choose a payment method: Instant Load, Bank Transfer or BPAY®

Use Travel Money

- Use your card at ATMs or anywhere Mastercard is accepted2

- Transfer money between currencies

- Cash out leftover funds to your Australian bank account

- Transfer funds to other Qantas Travel Money cardholders

Manage your account

- Lock and unlock your card

- View your card PIN

- Set your default currency

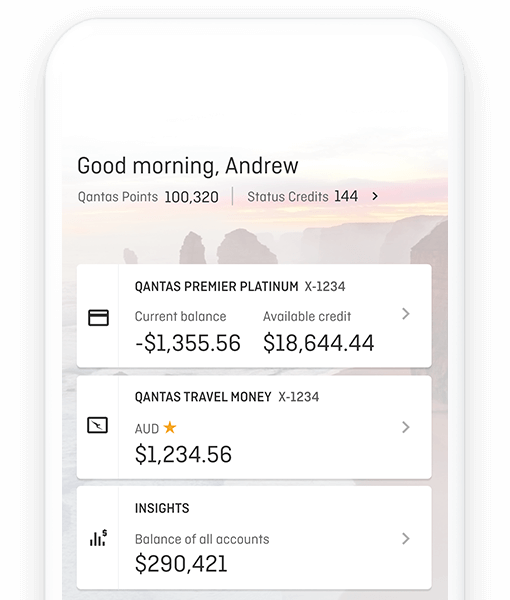

Get even more with the Qantas Money app12

Get even more with the Qantas Money app12

Big picture

Connect your accounts from other financial institutions and see them all in one place.

Earn Qantas Points

Earn 1.5 Qantas Points for every AU$1 spent in foreign currency.4

Spend insights

View spend by category to analyse expenditure.

Get offers

Link your Qantas Travel Money card and activate offers to receive bonus Qantas Points at your favourite stores.

Awarded by

We’re here for you every step of the way

To start using Qantas Travel Money make sure you are a Qantas Frequent Flyer member. Not a Qantas Frequent Flyer member? Join now for free and save $99.50

Make sure you have your Qantas Travel Money card, address details, drivers licence and passport handy. Don't have a Qantas Travel Money card? Request a card

Use your Qantas Frequent Flyer details to activate your Qantas Travel Money card. Activate your card

You’ll earn Qantas Points on eligible purchases* overseas, at home or online at the following rates:

Earn 1.5 Qantas Points for every AU$1 spent in foreign currency.

Earn 1 Qantas Point for every $4 spent in Australian dollars.

Qantas Points are calculated on the AUD conversion rate at the time of the transaction.

After you have successfully applied for Qantas Travel Money you can retrieve your PIN by logging in to the Qantas Money website or mobile app. Select your Qantas Travel Money account, then Manage > Reveal card PIN; or by calling Mastercard Qantas Travel Money Global Support on 1300 825 302.

You’ll need your card PIN to make purchases at point of sale and to withdraw cash at ATMs. We recommend you memorise your card PIN to prevent unauthorised use of your card.

If you would like to change your PIN, retrieve your existing card PIN first, then change it at one of 2,000 atmx by Armaguard ATMs Australia wide. Find your nearest atmx here.

Please note: your card PIN is different to your Qantas Frequent Flyer program PIN.

If your card is lost or stolen, contact Mastercard Qantas Travel Money Global Support on 1300 825 302 (from within Australia), or +61 1300 825 302 (if overseas). If your card is lost we’ll suspend it. If your card is stolen, we’ll close it to prevent fraud.

You may be eligible for an emergency cash disbursement, allowing you to access funds on your card, if your card is lost or stolen whilst you are overseas. Contact Mastercard Qantas Travel Money Global Support on 1300 825 302 (from within Australia), or +61 1300 825 302 (if overseas). If eligible, you can collect emergency funds from approved agent locations. The team will let you know the address details, telephone number and opening hours of the nearest agent location.

Need to speak to us now?

Call us 24 hours a day, 7 days a week.

While in:

Call us on:

1300 992 700Charges may apply.